|

Winning the Best Talent: 7 Hiring Strategies for Mid-Sized Companies

September 19th, 2024 by Amy SuitterBy Bill Benson and Jeff McGraw

Large companies that have name recognition often start with an advantage when attracting talent. Candidates know who they are and they often have a reputation for offering good benefits and opportunities. If you are going to win the best talent you will need to take a strategic approach.

Whether hiring finance or engineering talent, or seeking a specialized skill set, you will often be competing with one of these “name brand” companies. Large companies indeed have larger budgets, talent acquisition teams and the best technology. Here are ways you can improve your win-rate when competing for top talent:

1. Promote the Opportunity to Make an Impact

Employees feel particularly valued for their contributions when they have a noticeable impact on the company’s success. Create an environment where employees are allowed to take on broad responsibilities and projects that offer visibility within the company. Larger company roles tend to be narrower in focus and it is often harder to get noticed for promotion. Feature the ability to make an impact.

2. Focus on Career Development and Promotion Opportunities

As part of the onboarding and integration process, implement professional development plan. Connect the incoming talent with a mentor and develop continuous learning opportunities through on the job training programs. Expose them to broader roles and duties to keep them growing and learning.

Provide clear and attainable career advancement opportunities. In small to mid-sized organizations, employees often have the chance to wear multiple hats and take on new challenges, accelerating their career growth compared to larger companies

3. Fine Tune and Promote your Company Culture

Small to mid-sized companies are often close-knit, empowered, collaborative and more personal than a large company culture. Clarify the differences offered by your company in a way to differentiate yourself from larger companies.

- Work life balance is important to most employees. Develop comprehensive wellness programs and benefits that address physical, mental, and financial well-being. This can include gym memberships, mental health days, stress management workshops, and financial planning assistance. Offer family-friendly policies such as flexibility to attend a child soccer or football game, flexible working arrangements and work from home options.

- Engagement with the community. Promote a purposeful culture by offering time off to volunteer in the community. Encourage community involvement which can lead to referrals.

- Develop partnerships with local universities to tap into their talent pipelines. Offer internships, co-op programs, and collaborative research opportunities to attract emerging talent.

While large companies or “corporate” environments have their benefits, we find that more people enjoy working for small to mid-sized companies where they feel less like a number and have a closer connection to strategic decisions and top executives. Mid-sized companies are often less political, less bureaucratic and offer more direct opportunity and flexibility.

4. Offer Competitive and Flexible Compensation Plans

While you may not match the salary of larger corporations, you can offer customized benefits such as work life balance, flexible work hours, remote work options, or extra vacation days. Consider offering unique perks like student loan assistance, wellness programs, or professional development stipends.

Provide opportunities for employees to have a financial stake in the company’s success through equity options or profit-sharing plans. This can be particularly attractive to candidates looking for long-term growth and investment in the company’s future.

5. Flexibility and Agility

Highlight the ability to work on cutting-edge projects or contribute to innovation in ways that may be less accessible in larger, more bureaucratic companies. Smaller teams can pivot more quickly and implement innovative ideas faster.

Emphasize the benefits of working in an environment where decisions are made quickly, and employees can see the immediate impact of their work.

6. Take a More Strategic Approach to Recruiting

Turn to third party recruiting firms to help target and recruit candidates who are not answering postings. This will give you an advantage over companies who are relying on large advertising budgets.

Offer employee referral programs and encourage your best employees to identify potential past colleagues or classmates. They are often the best advocates to promote the opportunity to like-minded potential employees.

7. Human Touch

Large companies utilize AI and automation to screen and communicate with potential applicants. Hone your communication to be more personal in style and tailored to the individual. Outreach should focus on valuable information to a candidate not what is important to the employer. In other words, the posting or outreach content should be focused on “attracting” rather than “screening”. Describe what you would like the person to accomplish, which is more appealing than a list of requirements.

Your initial live contact with the candidate should be warm and focused on understanding what is important to them. Large corporations may use automatic messages as a first contact. You can differentiate yourself from the start to build trust with the candidate.

Hopefully these tips will help you win the best talent!

Happy Hunting.

Hiring for Culture Fit in 2023

March 21st, 2023 by Amy Suitter

Hiring for Culture Fit in 2023 by Bill Benson

Are you struggling to find people who will stay with you long term? Do you have an intentional process to evaluate fit? We still see companies screening and measuring candidates against largely tangible requirements. Most companies see the importance of culture fit, but it hasn’t translated to the interview process. A best practice would be to evaluate both tangible and intangible qualities. If someone fails or leaves after a short time it is often related to how they fit within the company or some other intangible factor. Hiring an employee that fits well with the team and has a baseline of experience to build from is often a better hire than someone who has all the experience but doesn’t fit the company well.

It is easy to attach confidence to a candidate with parallel experience or be infatuated with a specific aspect like a skill set or competitor experience. Many of the factors we see as important are often skills that can be learned. Personality, drive, character, willingness to change, interest in learning and many other factors are inherent and won’t change.

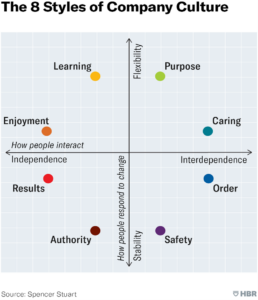

The most discussed aspect of fit is “culture fit.” Culture fit refers to the compatibility of an individual with a company’s values, beliefs, and working style. The idea behind hiring for culture fit is that employees who share the company’s culture are more likely to be happy, productive, and stay with the company longer.

Consider employees within your company who are succeeding. What are the qualities they possess that make them successful? They have a good understanding of what it takes to be successful in your organization. It’s important to take a good look at the factors pivotal to the success of your top employees. This gives you insight on qualities to seek with your new hires.

When considering culture fit in the hiring process employers typically assess an applicant’s values, communication style, work ethic, and personality. This can be done through various methods such as:

Interviews: The interviewer can ask open-ended questions such as, “describe a culture that is a good fit for you?” “What elements or characteristics are you seeking in your next work environment?” “If you could wave a magic wand – what would you change in your current environment?” Here are some additional questions to consider.

References: Speaking to the candidate’s past colleagues or managers can provide insights into their work ethic and how they fit into a team.

Behavioral and situational interview questions: These types of questions can provide insight into how the candidate might handle different scenarios in the workplace.

Work samples and tests: Review a candidate’s previous work or give them a test or project that can give a clearer idea of their skills and abilities, as well as their approach to problem-solving.

Company events and activities: Inviting candidates to company events or activities can give them a sense of the company culture and help determine if they would be a good fit. Having the potential candidate spend some time in your environment will also give you a feel for how they fit.

Dinner or lunch: Having a candidate out with a small group in an informal setting like dinner or lunch will give you insight into their social skills.

Family-owned businesses have unique challenges and opportunities when it comes to hiring and building a successful workforce. Typically, these companies have strong cultures that value people, customers, relationships and teamwork. In the post covid environment, many of these family business values resonate with employees looking for stability in a caring environment. It is critical for these culture rich environments to take extra time to evaluate alignment. Here are a couple of tips for family businesses leaders:

- Designate a key family member who has strong alignment and passion for the culture of the organization and involve them in the interview process.

- Have a clear understanding of the elements that make up your culture and use those to help promote your brand. Elements like a focus on safety or employee development are examples that reinforce an environment that is meeting the needs of its employees.

- Trusting relationships are developed when the employee believes the employer is focused on collective interests rather than profit. Make sure interviews are a two-way street where you ask questions about what is important to the candidate and what is important to you.

- Develop purposeful opportunities for employees to volunteer and get involved with a community or not-for-profit organization. These activities will reinforce your culture of caring.

Here are some areas of “fit” to check that can contribute to an employee’s success:

1. Readiness to adapt and change

2. Self-Directed

3. Motivation and Drive

4. Values Alignment

5. Interest in Learning – Creative, Inquisitive

6. Capability to Work Collaboratively

7. Emotional Intelligence

8. Pro-Active – Able to “see the work” as well as execute.

9. Leadership Style

10. Character and Integrity

The cost of a hiring mistake can be 3-5 times the amount of the employee’s annual salary. A good interview, reference and assessment process will help you find a great fit for your organization.

Happy Employee Hunting!