By Bill Benson and Jeff McGraw

No one can deny the clouds forming on the workforce horizon. At WilliamCharles Search Group, we are involved with TalentFirst, an organization focused on building a future-ready workforce. As leaders we have recently focused on a report from Lightcast, which named this coming wave “the rising storm”.

At this immediate moment, we could call it the calm before the storm. Tariffs and softer markets in specific segments, including the automotive industry, have slightly softened demand. This market has caused a hesitancy among employees to change jobs, so employers may enjoy a temporary respite from a high demand/low supply labor market.

What is the rising storm? About 15 million baby boomers are expected to retire in the US over the next five years. These retirements are poised to impact sectors including health care, manufacturing and construction the hardest. This issue is further exacerbated by a decline in younger workers entering these fields. Many retiring individuals are in either leadership roles or skilled trades – employees not easily replaced.

There are no simple solutions to this complicated issue. If you haven’t already planned out how to weather this storm, let’s look at some ways to give your organization an advantage. Here are 6 steps you should be taking today.

- Understand your risk. Determine the number of employees over 60 who are set to retire in the next five years and the corresponding critical roles you will need to fill. Do the same for age groups 55-60 and 50-55. Identify the 1-3 most vital and hardest-to-fill roles and related skills. This will lay the foundation for your succession planning.

- Launch a Knowledge Transfer Strategy. Identify the knowledge, skills, and expertise that are critical to your business’s differentiating advantage. Create a plan to capture this information and knowledge and begin the transfer process. Identify other training sources to add value to these critical skill gaps.

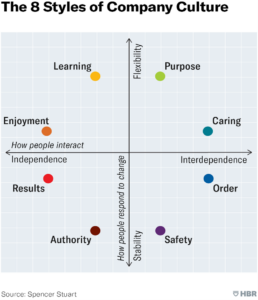

- Focus sharply on upskilling, training, and leadership development. Building people’s skills should be a top priority for all companies. Every key employment survey indicates that a culture focused on developing people will help you retain key talent.

- Hire a Strategic HR leader who focuses on more than compliance and basic HR functions. You will need someone who is committed to business goals and challenges and can solve problems and think critically. A strategic HR leader is a critical resource for managing change and driving team building.

- Expand your resources:

- Tap resources within your community to help. Understand the partners in your community who can assist with ideation and support in addressing these challenges. In West Michigan, we have great resources, including TalentFirst, Family Business Alliance, Michigan Works, and the Grand Rapids Chamber of Commerce. In the Pittsburgh area we have Partner4Work, Vibrant Pittsburgh, and the Pittsburgh Technology Council.

- Develop peer groups with other organizations to share ideas and collaborate on identifying best practices.

- Build relationships with community colleges and adult education resources to create tailored programs.

- Communicate the plan internally: Ensure transparency in workforce planning. Equip managers to hold regular conversations with their teams. Conduct stay interviews with employees to develop strategies for retaining them longer.

The info above was based on national data from Lightcast and their A Demographic Drought report. This info was regionalized by TalentFirst. Special Thanks to Kevin Stotts, Carly Smyly and the team at TalentFirst for sharing this helpful content. Feel free to contact Carly to engage and get involved.